Kuala Lumpur, February 2022 – VIENNA Advantage, the enterprise level open source ERP provider obtained a certification from the Malaysian government which puts the company in the official list of software vendors of computerized Payroll System/Employer which comply with the MTD 2012/2013/2014/2015/2016/2017/2018/2019/2020/2021 calculation specifications, issued by The Inland Revenue Board of Malaysia (LHDNM).

What is MTD?

Monthly Tax Deduction (MTD) is a mechanism that requires an employer to deduct individual income tax, at source, from the employment income of its employees. Taxes due on benefits-in-kind and all taxable reimbursements are settled when an individual submits the annual income tax return to the Malaysian Inland Revenue Board (LHDNM).

What are the benefits of having localized payroll solution?

Malaysian employers are mandated to calculate and ensure that the MTD remitted to the LHDNM on employment income is equal to the total tax liability payable by the employee for the year of assessment. One of the many benefit that VIENNA Advantage Payroll solution brings to Malaysian employers is that they will not need to obtain further verification from LHDNM.

Additionally, our localized payroll solution covers the requirements of statutory bodies such as: EPF (Employee Provident Fund), SOCSO (Social Security Organization), EIS (Employment Insurance System), HRD Levy (Human Resource Development), Income tax, etc. VIENNA Advantage payroll solution has been tested by LHDNM through various test cases and successfully generated expected results, thus providing assurance to customers that our product will comply with the norms of LHDNM.

Commenting on the company achievement, Atul Dua, CEO at VIENNA Advantage, said: “This is an important milestone for our company, as well as for our clients! We work with publicly listed and mid to large enterprises in Malaysia with thousands of employees. They will now be able to ensure compliance to LHDNM regulations – powered by VIENNA Advantage Payroll system.”

What is the cost of not being compliant to LHDNM regulations?

From a penalty perspective, an employer will be liable to a penalty of no less than RM200 and not more than RM20,000 or to imprisonment for a term exceeding 6 months or both. If there is a taxable income that has been under-reported for employee tax reporting purposes, this would attract an even higher penalty rate of 45% of the undercharged tax under the current Tax Audit Framework. This increases to 55% for repeated offences upon being audited or investigated.

Apart from the above, under Section 75A of the Malaysian Income Tax Act, 1967, LHDNM has the right to recover any MTD that the employer has failed to remit together with any penalties imposed on the directors (each of whom must hold at least 20% of the company’s ordinary share capital) of the company. The recovery action would include issuing stoppage orders to prevent the Director from leaving the country until the tax liability is fully discharged by the director concerned.

What should employers do next?

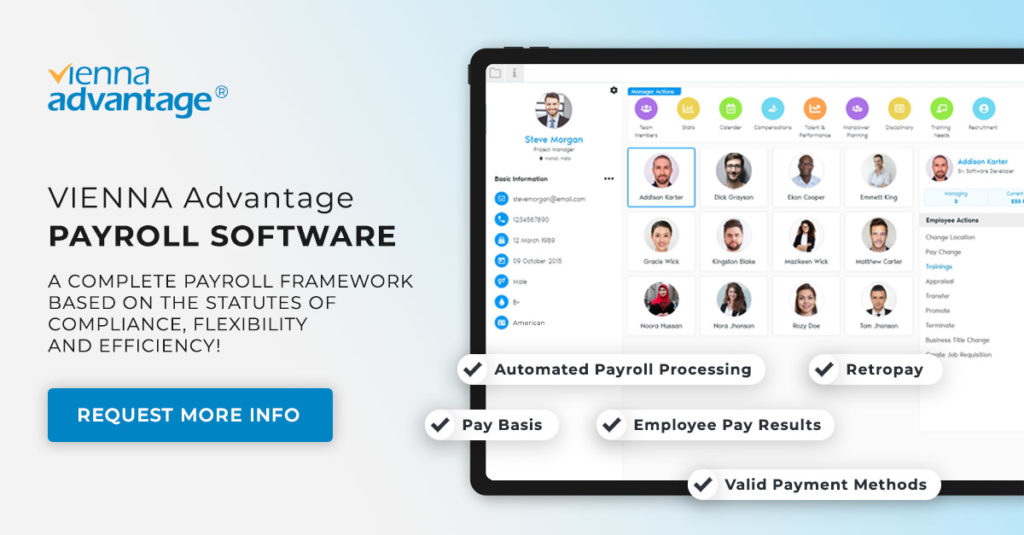

The easiest way to ensure compliance, while keeping your HR and payroll department efficient is to go for a certified payroll software like the one offered by VIENNA Advantage. Contact us today to learn more about our solution and request demo. Click on the following link.

About VIENNA Advantage

VIENNA Advantage is a German provider of flexible and scalable software solutions for the private and public sectors. Our Malaysian subsidiary, VIENNA Advantage Asia Sdn Bhd, is located in Kuala Lumpur.

The core product is a low-code and no-code development framework that enables companies to create business applications in the shortest possible time. The flagship in the product portfolio is VIENNA Advantage ERP and CRM, built on its own framework, a complete business management suite for medium to large enterprises.

Local contact

Mohd Amiruz Dzaki Muhammad Danil

Sales Director

amiruz.dzaki@viennaadvantage.asia

+6019 313 8893

VIENNA Advantage – Digital Enterprise. Delivered

Learn more at: https://www.viennaadvantage.com/ or follow us on social media: LinkedIn, Twitter, Facebook, You Tube.