Digital transformation and the 4th Industrial Revolution are substantially changing the CFO role within an organization. In the past, the key role of a CFO was to be a protector of financial integrity, but today this role is evolving to include driving operational performance and efficiency, actively engaging in internal and external strategy, and more. CFOs know that their enterprises must become digital organizations. The question is not whether, but where and how much their firms should spend to compete in an increasingly complex digitalized marketplace.

In a recent CFO Research / Grant Thornton study, 69% of CFOs said that next year they will invest more in digital transformation where as 66% said that they will manage substantially more technology. Speaking about technology, the backbone of every midsize to large organization in the world is its ERP software solution. As the finance function evolves to take a larger role within an organization, the CFO’s priorities change too.

CFO requirements from an ERP solution in the digital transformation journey

#1 Advanced analytics and business intelligence

Today, and in the foreseeable future, the CFOs and their teams would need to be effectively augmented by an enterprise resource planning (ERP) solution that is capable of providing real-time and in-depth analytics to not only support the digital transformation journey, but also the overall decision-making process.

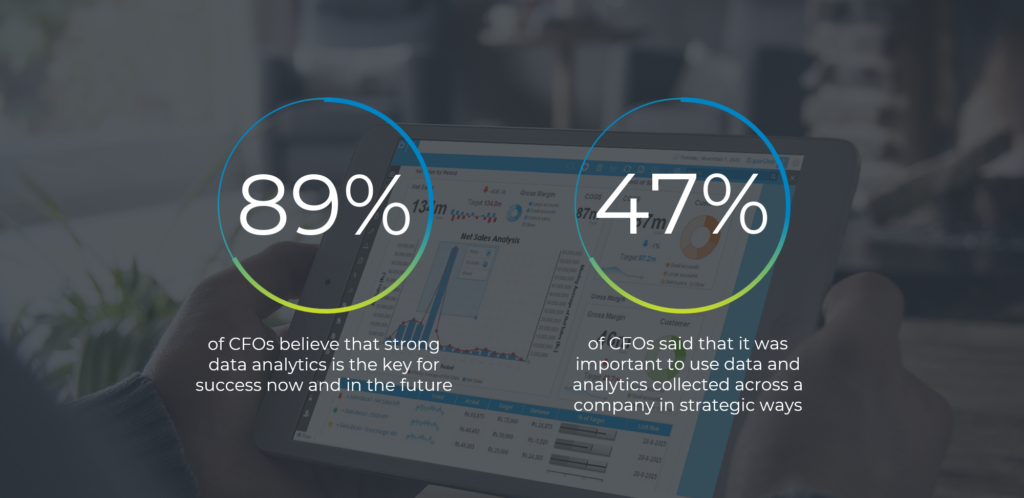

In a recent survey by CFO Research on digital transformation with 689 senior finance executives in the United States and Europe, nearly half (47%) of the surveyed CFOs said it was important to use data and analytics collected across a company in strategic ways. In another study published by CFO Research / Grant Thornton which included 304 executives, 89% of the surveyed CFOs believe that strong data analytics is the key for success now and in the future.

Conventional metrics for financial success are evolving with the use of technology. Today’s new measurements are providing greater insight into the health of the business and support better business decisions. The digital transformation of your finance department as well as your organization starts with implementing an ERP solution that comes with an inbuilt Business Intelligence system capable of providing analytics to improve the decision-making process in your company.

#2 Solve operational problem of finance and accounting users

In the CFO Research survey, 60% of the finance executives said they will devote at least 20% of their finance budgets to digitally transforming the function. Having said that, an ERP software solution should be the key tool to support the transformation of the finance function into becoming a driving force in the company’s digital transformation journey. It is expected that this software would bring automation in daily tasks to eliminate manual processes and solve operational problems of the finance and accounting users.

When it comes to conglomerates and large multinational corporations, an ideal ERP solution should be adoptable by the entire business group. Functions such as group-wide financial consolidation, that finance users take weeks to accomplish, could be completed in a matter of hours with a good ERP solution. This efficiency could only be achieved if every subsidiary is able to afford and run on the same ERP platform, and transactions are recorded at individual subsidiary level across the entire group. This solves some of the most significant challenges of finance and accounting users in the organization.

#3 Maximize ROI from ERP investment

One of the key roles of every CFO in the company’s digital transformation journey is to take a call on the budget for an ERP solution with the best functionality, lowest implementation time and reasonable cost of ownership.

The Group CFOs’ unenviable dilemma is to build a business case of an Oracle or SAP implementation across the entire group of companies, considering that these ERP solutions are priced at a premium and come with complex licensing models.

A few subsidiaries that generate 80% of the group’s revenue are able to afford SAP or Oracle ERP. The remaining subsidiaries are forced to go with other, relatively inexpensive, but deficient ERP solutions. This approach leads to an extremely heterogeneous IT landscape across the group of companies and results in severe inefficiencies as well as jeopardizes the implementation of the digital transformation strategy.

The right approach to maximize the ROI of the ERP investment would be to find feature rich solution that could support your digital transformation strategy and at the same time be affordable to all subsidiaries within a group of companies.

VIENNA Advantage ERP comes with very simplified licensing model. We charge on a per named user basis for both perpetual and SaaS models. This means that there is no surcharge that customers need to pay per legal entity, or per ERP module. This has very fundamental implication!

Firstly, the cost of ownership compared to popular solutions such as SAP or Oracle is significantly lower, without sacrificing on the core ERP functionality. This means, customers can replace their existing ERP solution with VIENNA Advantage at a lower price. More importantly, it allows all subsidiaries in a group, regardless of their individual revenue, to be able to afford VIENNA Advantage and achieve a homogeneous IT landscape across the entire group of companies. This forms the very core of your digital transformation initiatives, with the ERP solution being the backbone of your organization.

#4 Shorter implementation time

The median shelf life of an ERP solution is about 10 years. Traditional ERP solutions, like SAP or Oracle ERP, take anywhere between 3-4 years to implement, depending on the complexity involved. This leaves the company only 6-7 years to productively use the ERP to support its digital transformation journey and realize the returns from the ERP investment.

VIENNA Advantage ERP has dramatically shorter implementation timeframes (around 2 years), leaving customers with 8 years of productive usage of the ERP. In this way customers have 10-15% of additional productive usage of the ERP and therefore a higher return on their investment. This is because of the inherent architecture of the VIENNA Advantage ERP that allows for rapid configuration, customization and deployment.

This means that the implementation cost, often the largest component of an ERP investment, is reduced by a significant factor, allowing VIENNA Advantage customers to realize cost savings.

#5 On-premises vs cloud ERP (SaaS) solution

According to recent Gartner’s research, companies around the world spent $227.8 billion last year on public cloud services, and they’re projected to spend 17% more ($266.4 billion) this year. With that in mind, it’s not a surprise that 4 in 10 (39%) surveyed CFOs, in the CFO Research, said that leveraging cloud computing is a major challenge for them. The critical question that many CFOs could help their companies’ CIOs answer is: What is our financial justification for shifting from on-premises ERP to a cloud ERP solution?

About VIENNA Advantage ERP

VIENNA Advantage ERP/CRM is the first enterprise-level open source ERP and CRM solution with inbuilt document management and business intelligence system, available on the cloud and on-premises. Realize strategic goals with one enterprise application across the company. Hundreds of features within the tightly integrated ERP and CRM solution.

Are you ready to start your digital transformation journey?

Experience the award-winning enterprise level ERP/CRM software. Schedule your personalized demonstration today. It’s free!

⚠️ You might be also interested in reading the following article 👇

Digital Transformation: 4 CIO priorities when choosing an ERP solution